WHAT IF...Jim Lee got Royalties Forever on his X-Men Original Art?

We're back with a look at NFT royalties and what it means for creators.

I’m back!

I’ve been to Lisbon, Edinburgh, and London since you last heard from me. I’ve been at endless conferences and meetings and it feels good to be able to sit down again and start sending out this newsletter again.

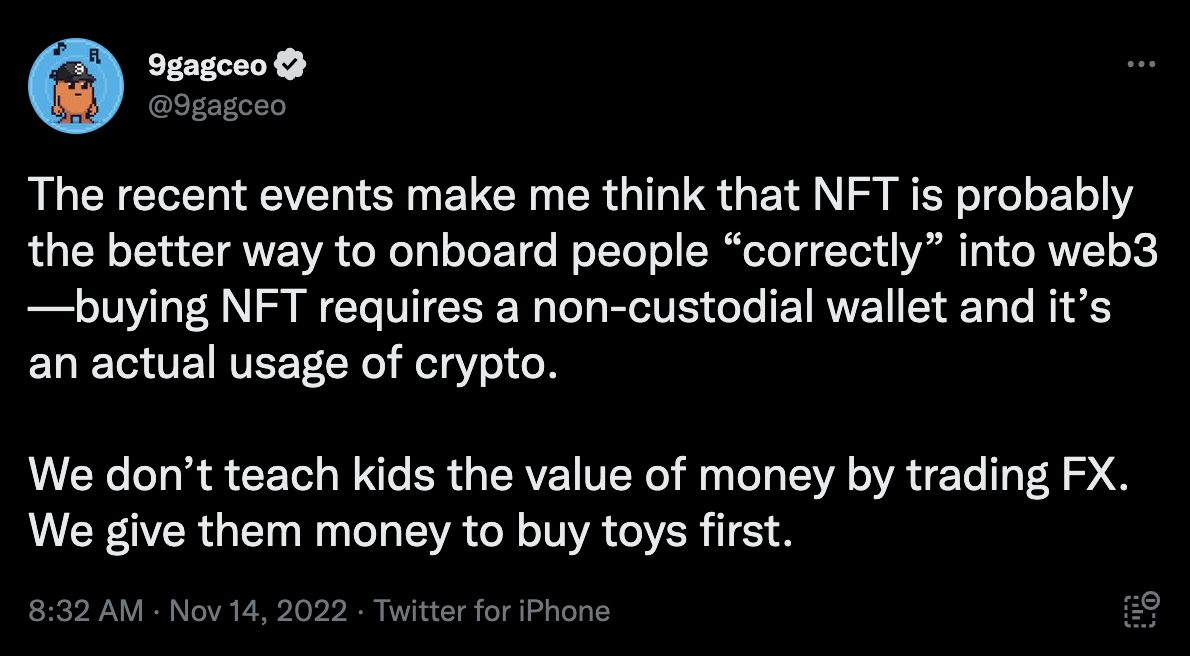

As the FTX world is/has collapsed, the NFT and digital collectibles world continues to build. Ray Chan of Memeland said it best:

…or better yet: comics.

Last week, I picked up a few of the Cryptoys’ Masters of the Universe digital action figures - I really like these, and I like the idea of onboarding people this way. BUT, I don’t like anything without a self-custody wallet, if the site goes down or gets hacked you can lose everything and that was the problem for users that left money on FTX, and what Web3 is pushing for. But it looks like they will keep you locked into their Marketplace.

A friend really got into DC’s Hro cards and has been making some real cash by re-selling them in their marketplace. So there is seemingly a good market to buy and trade physical/digital cards.

The Hro app is where you do everything + their website - none of these digital collectible NFTs are doing self-custody exchange wallets and none of them are on open exchanges like OpenSea - the #1 reason for this is to maintain the royalties - and it seems on Hro royalty payments are as high as 10% a sale. Most NFT’s on OpenSea have a 5% creator fee.

This is what this issue of the newsletter is all about: Royalties.

When you buy an NFT

That NFT original price - anywhere from FREE to say 1ETH (currently $1275) - is the main revenue the project can make times how many pieces in the collection (traditionally 10,000).

The reason why some NFTs are free is that they can make money on secondary sales royalties. Like GoblinTown. But they must have seen the writing on the wall, as they already opened their own Marketplace that will keep royalties in place.

The Royalty

That % is something that the project can set anywhere from 2-5% on all future sales - so imagine if Marvel could have attached a resale royalty to every copy of X-Men #1 in 1963. Or if Jim Lee could have attached a 5% royalty to every piece of original artwork sold during his entire career? So that every time it’s sold to a new collector he would see some $ come his way, which also may be shared with the inker.

This double-page spread from X-Men #268 is STARTING at $57,500 - it will easily hit 6-figures (my guess $250,000 - update: actually it closed at $78,000 - a bad economy? The cover for this issue sold for $300,000 in 2020. Also, I discovered these pages were still in his possession and he put it up for auction himself.) currently, Jim sees $0 on this and it will be resold again in his lifetime for more.

So the world of NFTs is as speculative as comics and Pokemon cards - any way a trader can get around eBay commissions or Heritage Auction’s Buyer’s Premium fees people will do in NFTs and collectibles and now because the crypto market is down they are doing just that.

Marketplaces like Magic Eden - who trade mostly only in Solana NFTs decided to make non-enforceable royalties optional to stay competitive with other unsavory marketplaces that were gaining a foothold on the incumbent because they removed royalties first. The market gets very cutthroat and loses sight of what the whole NFT thing was about at the beginning (protecting creator rights and being able to monetize their work forever.)

The Hulk 181 Analogy

If I put a copy of a CGC 9.8 Hulk #181 on Facebook Marketplace or Craigslist to sidestep the 12.8% you need to give to eBay (+ 3% of the selling price since that comic book is well over the price threshold) this is a platform fee that will always be there and how the marketplace makes money.

BUT with creator royalties, there could be a piece of this going to not only Marvel but Len Wein and Herb Trimpe the writer and artist of this particular comic and the co-creators of WOLVERINE, not to mention Stan Lee and Jack Kirby the co-creators of The Hulk - - and they were living off this type of royalty since 1975 (when the comic would have started to have a movement on the secondary market) their families would be very very well off today.

There are 16,219 copies of Hulk #181 on the CGC census in different grades.

For NFT collections like Deadfellaz or Doodles, the projects use those royalty funds to pay for staff and the development of future projects coming from the brand.

So the royalty issue, if not properly enforced, is a problem going forward.

Apparently, the smart contracts, aren’t that smart and don’t actually lock in the royalty and it’s up to the actual marketplace to enforce it.

To not lose market share, OpenSea was flirting with the idea.

But, because of tweets like this from prominent artists:

And full-on posts by people like GordonGoner one of the co-founders of the Bored Ape Yacht Club:

1) The NFT ecosystem would be a tiny fraction of what it is today if it weren't for creator royalties.

2) The leading marketplaces of the past couple years would be nowhere if they hadn’t supported them.

So, they decided against it.

But how long can they withstand it during a bear market?

In October, OpenSea has 66% of the NFT marketplace share today. NFTs are more like trading commodities, just like 90’s comics were investment vehicles instead of reading material and we all know where that went.

If this sounds convoluted, just imagine a movie or a TV show and then look at all the streaming shows and every creative person involved that is part of a union. There is a big Hollywood strike coming next year. The fight for creatives getting paid is heating up now and with a technology that can publicly show every stream, download and merchandise sold…

This is only the beginning.

Quick Hits

What a week it’s been for the crypto world with FTX and all the fall-out there - I highly recommend newsletters like The Milk Road if you want to have a fun and efficient daily blast of crypto news.

I really enjoyed this PROOF podcast interview with Ray Chan the founder of 9GAG and now Memeland - where he is selling Potatoz NFTs and the community he has built.

We spoke about Polygon joining the Disney Web3 Accelerator a while back - well, they graduated - here are all the teams that went through the program.